Inflation and Erosion of Purchasing Power

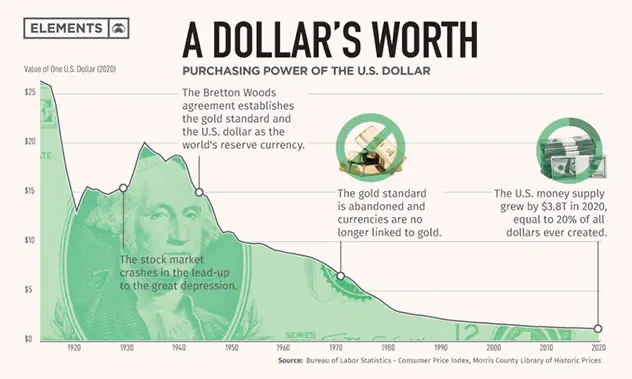

Fiat money is vulnerable to inflation, a phenomenon where the general price level rises over time. Central banks, which control the money supply, may choose to print more money to stimulate economic growth or meet fiscal obligations. However, an increase in the money supply without a corresponding increase in goods and services can lead to higher prices, eroding the purchasing power of individuals and diminishing the value of savings.

Debt and Dependency

Fiat money encourages borrowing and debt accumulation. Governments, businesses, and individuals often rely on credit to fund investments and consumption. While debt can stimulate economic growth, it also creates a dependency on continuous economic expansion to service and repay the debt. When debts become unmanageable, as witnessed in financial crises, it can result in severe economic downturns and even sovereign debt crises.

Moral Hazard and Bailouts

Fiat money systems may give rise to moral hazard, where individuals and institutions take excessive risks with the expectation of being bailed out by governments or central banks in times of crisis. This belief that “too big to fail” entities will be rescued can lead to reckless behavior, as the burden of potential failures is shifted to taxpayers and the broader economy.

Wealth Inequality

Inflation and debt-driven policies can exacerbate wealth inequality. The wealthy, who have greater access to financial assets and investment opportunities, can benefit from inflationary policies that increase asset prices. In contrast, those with limited financial assets, especially those on fixed incomes, may struggle to keep up with rising costs of living. The gap between the rich and the poor can widen, leading to social and economic tensions.

Loss of Confidence and Hyperinflation

Fiat money systems are vulnerable to loss of confidence. When people lose faith in a currency’s value, hyperinflation can occur, rendering the money worthless for everyday transactions. Historic examples of hyperinflation, such as in Zimbabwe and Venezuela, have had catastrophic consequences on economies and the well-being of citizens.

Interference with Market Signals

Fiat money, controlled by central banks and governments, can interfere with natural market signals. Interest rates, manipulated by monetary authorities, can distort investment decisions and create asset bubbles. Central bank interventions in financial markets can lead to misallocation of resources and malinvestment, potentially destabilizing economies.

Bitcoin Economics: A Paradigm Shift

Bitcoin’s limited supply, fixed at 21 million coins, stands in stark contrast to the unlimited issuance of fiat currencies. Its deflationary nature promotes saving and long-term value preservation, fostering a different economic perspective.

The absence of central control in Bitcoin ensures that no single entity can manipulate its value or dictate monetary policy. Instead, Bitcoin relies on the consensus of its network participants, creating a self-governing and transparent financial system. As more individuals and institutions adopt Bitcoin, it could further disrupt traditional economic paradigms and shape a new era of global finance.

Conclusion

Fiat money has been the cornerstone of modern economies for decades, but it comes with inherent challenges that affect individuals, societies, and nations. From inflation and wealth inequality to the erosion of purchasing power and market distortions, the shortcomings of fiat money systems have been evident throughout history.

Bitcoin’s emergence as a decentralized and deflationary alternative opens the door to new possibilities in the world of finance. As we continue to explore the complexities of monetary systems, the significance of Bitcoin’s innovative approach and its potential to reshape the future of global economics cannot be underestimated.