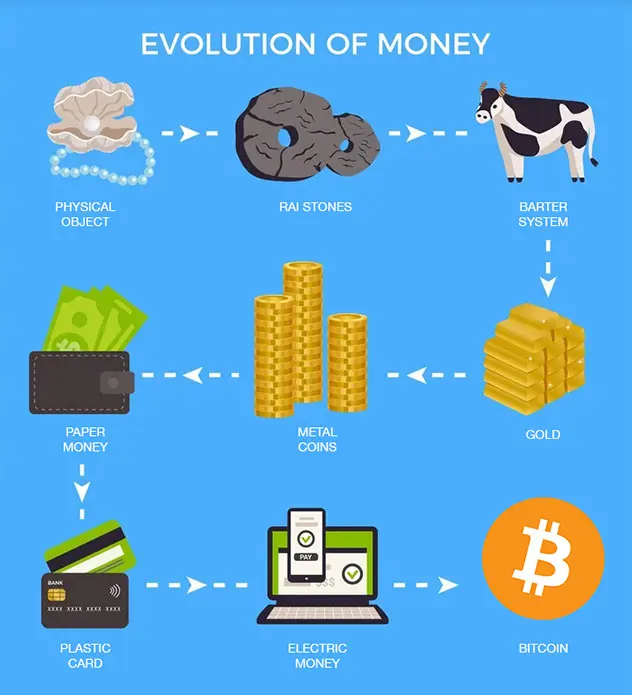

The Origins of Barter and the Need for Money

In the early days of human civilization, direct barter was the primary means of exchange. People exchanged goods and services directly, but barter systems had inherent limitations, such as the need for a double coincidence of wants and difficulties in determining the value of different goods.

The Birth of Primitive Money

To overcome the limitations of barter, early societies turned to using primitive forms of money. These were commodities with intrinsic value and widespread acceptance, making them ideal for facilitating trade. Examples include cowry shells in various coastal regions, metal objects such as copper and bronze, and commodities like salt and spices in different regions around the world.

The Rise of Rai Stones

Among the fascinating examples of primitive money, Rai stones stand out as a unique form of currency used on the island of Yap in present-day Micronesia. Rai stones were large, doughnut-shaped discs carved out of limestone, with a hole in the center. They were not physically transported during transactions but remained in place as ownership was transferred verbally.

Rai stones served as a symbolic representation of wealth and were used for significant transactions, such as dowries, land deals, and important agreements within the community. Their value was determined by factors like size, craftsmanship, and the difficulty of obtaining and transporting them.

The Emergence of Metal Coins

As civilizations advanced, metal coins emerged as a more practical and standardized form of money. In ancient Lydia (modern-day Turkey) around the 7th century BCE, the first known use of metal coins, made of electrum (a natural alloy of gold and silver), marked a crucial milestone in the history of money. Metal coins were durable, easily divisible, and universally recognized, making them highly convenient for trade.

The Gold Standard and the Age of Empires

Gold, with its scarcity and lustrous properties, became a preferred medium of exchange and store of value across empires and civilizations. The gold standard, which linked the value of currencies to a specific amount of gold, was adopted by various countries during different historical periods.

The Rise of Paper Money and Fiat Currency

Over time, the need for carrying heavy metal coins led to the issuance of paper money, backed by precious metals. As trade expanded and economies evolved, the gold standard was eventually abandoned, and paper money became the predominant form of currency. In the 20th century, most countries transitioned to fiat currency, which is not backed by any physical commodity but derives its value from the trust and confidence in the issuing government.

The Digital Age: Bitcoin and Cryptocurrencies

In the 21st century, the emergence of Bitcoin revolutionized the concept of money once again. Born out of a desire for a decentralized and censorship-resistant currency, Bitcoin introduced the world to the potential of cryptocurrencies. As a peer-to-peer digital currency, Bitcoin operates on a decentralized network using blockchain technology, where transactions are recorded securely and transparently.

Conclusion

The history of money is a testament to human ingenuity and adaptability in meeting the needs of commerce and trade. From Rai stones to metal coins, from paper money to the digital realm of cryptocurrencies, money has continuously evolved and transformed throughout history.

Bitcoin, with its revolutionary principles of decentralization, scarcity, and transparency, represents a new chapter in the story of money. As we continue to explore the complexities and possibilities of the financial world, it is essential to appreciate the rich tapestry of monetary evolution that has shaped the way we conduct transactions and store value. From ancient civilizations to the digital age, the journey of money remains an integral part of the human experience.